As the UK market grapples with global economic challenges, notably the sluggish recovery in China impacting commodity prices and export figures, investors are increasingly looking towards stable income sources like dividend stocks. In such uncertain times, a good dividend stock is characterized by its ability to offer consistent payouts and financial resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.54% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.09% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.63% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.22% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.55% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.14% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.89% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.77% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.61% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Dividend Rating: ★★★★☆☆

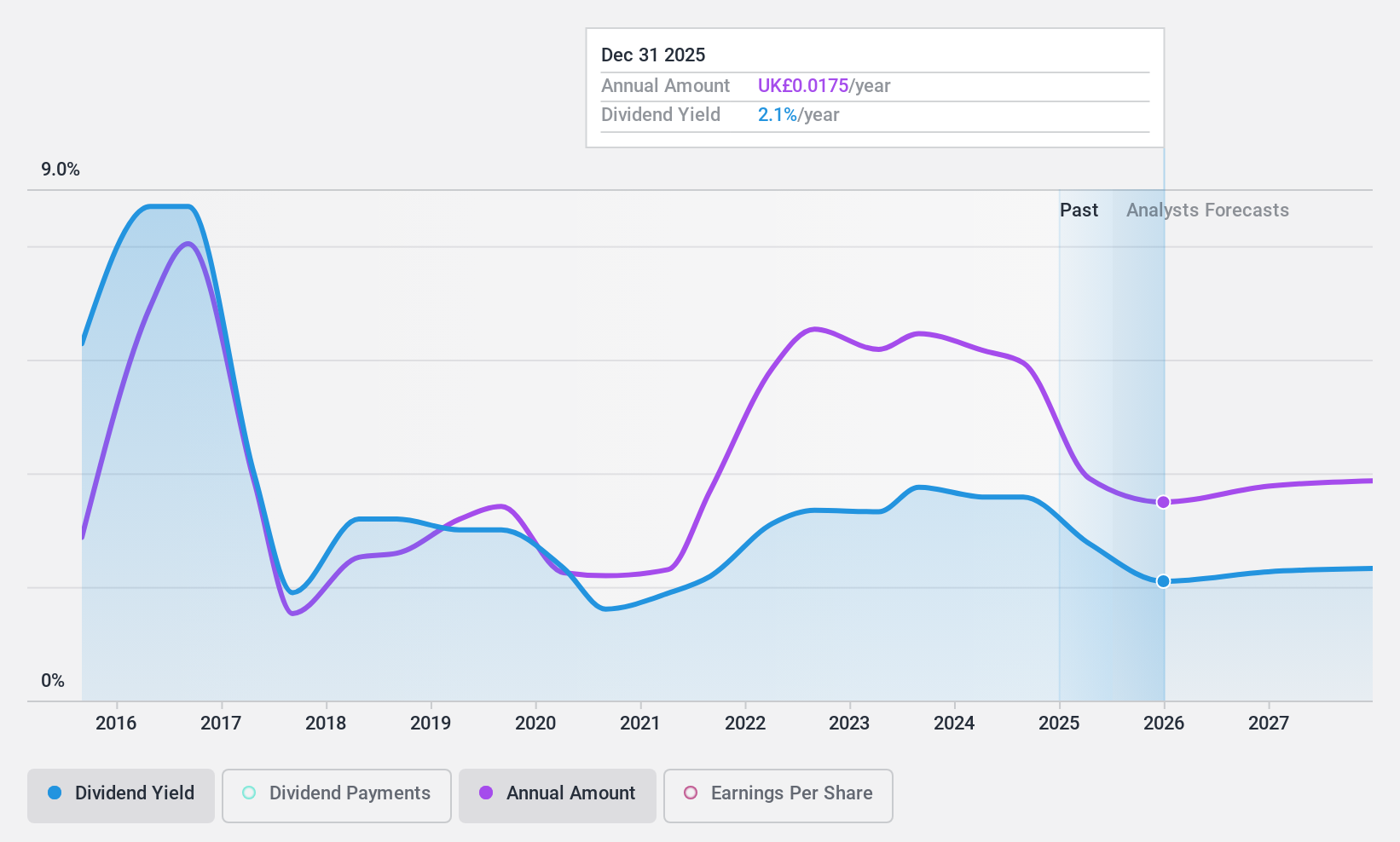

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom with a market cap of £221.91 million.

Operations: Vertu Motors plc generates revenue of £4.79 billion from its operations in the gasoline and auto dealership sector within the United Kingdom.

Dividend Yield: 3.6%

Vertu Motors offers a mixed dividend profile with recent growth in payments over the past decade, though they have been volatile. The company’s payout ratios are sustainable, with earnings and cash flows covering dividends comfortably at 41.8% and 17.8%, respectively. However, its dividend yield of 3.58% is lower than top UK payers. Recent share buybacks reflect strategic capital allocation but coincide with declining profits and net income from last year, potentially impacting future distributions.

Simply Wall St Dividend Rating: ★★★★☆☆

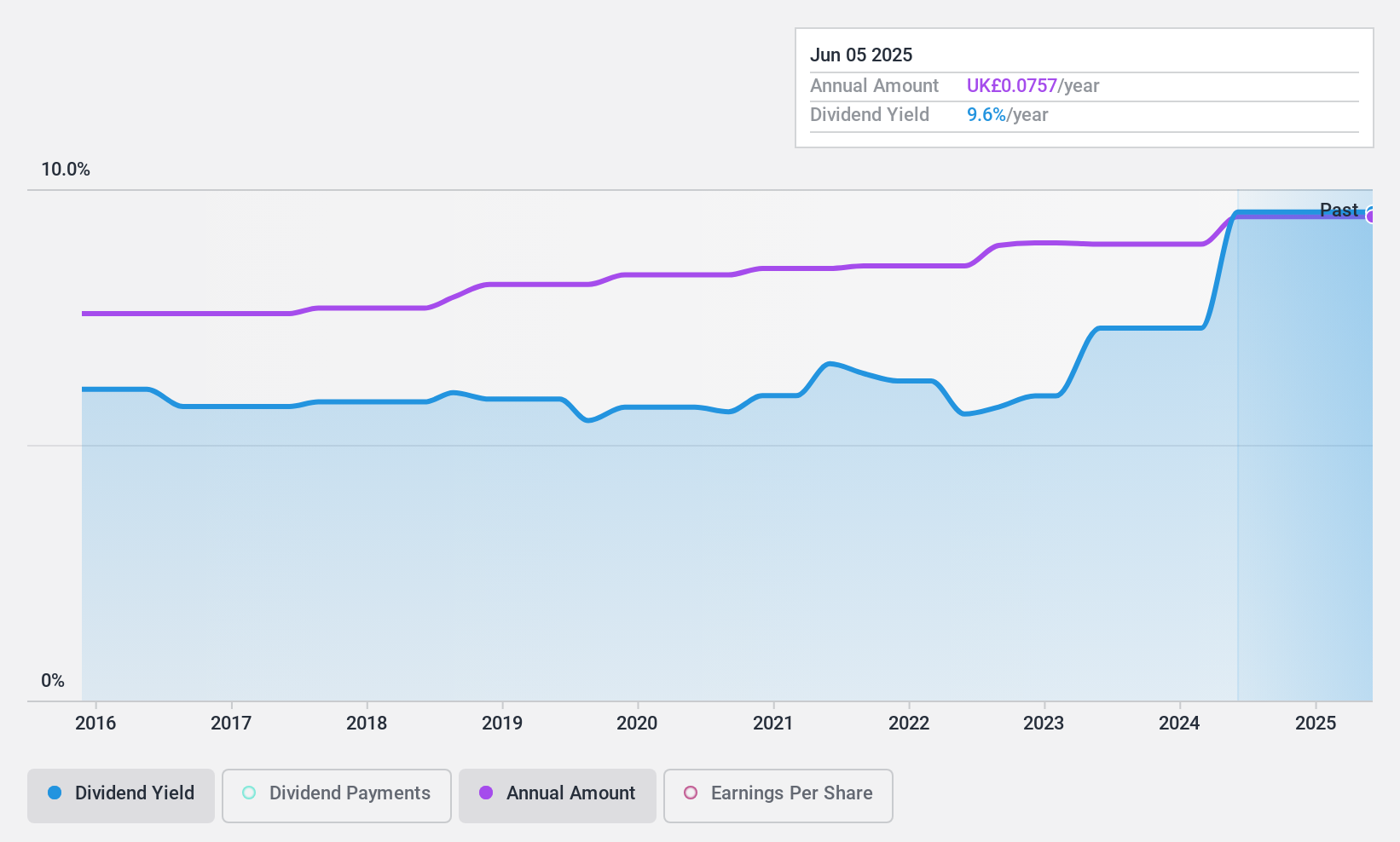

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market capitalization of £164.86 million.

Operations: Capital Limited generates revenue primarily through its Business Services segment, amounting to $333.59 million.

Dividend Yield: 3.5%

Capital Limited’s dividend profile shows sustainable payout ratios, with earnings and cash flows covering dividends at 26.1% and 24%, respectively. Despite a declared interim dividend of $0.013 per share for 2023, the company’s dividend history is marked by volatility over the past decade. Recent financials reveal increased sales to $169.43 million but a decline in net income to $9.21 million for H1 2024, potentially influencing future payouts amidst ongoing board changes and strategic adjustments.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Environmental Infrastructure, operating under John Laing Environmental Assets Group Limited and managed by John Laing Capital Management Limited, has a market capitalization of £557.71 million.

Operations: Foresight Environmental Infrastructure’s revenue segment includes an investment in environmental infrastructure amounting to -£3.83 million.

Dividend Yield: 8.8%

Foresight Environmental Infrastructure’s dividend yield is among the top 25% in the UK, yet its sustainability is questionable due to a lack of free cash flow and profitability. Despite stable and growing dividends over the past decade, payouts are not covered by earnings or cash flows. The company trades at nearly 10% below estimated fair value. Recent buyback plans worth £20 million may impact future dividend capabilities amid financial constraints.

Seize The Opportunity

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com