The sports betting market has really exploded in recent years, with numerous televised sports programs bombarded with advertisements to lure sports fanatics over to their platforms. Indeed, sports betting is a booming market, and it’s one that growth investors may wish to pursue as the top platforms gain new customers. In the public markets, investors can get a piece of the action with sports betting kingpin DraftKings (NASDAQ:DKNG) and its rival, FanDuel-owner Flutter Group (NYSE:FLUT).

But which play is the better bet? Let’s check in with the analyst community in this piece to see where they stand using none other than TipRanks’ Comparison Tool.

Placing a sports bet is no longer just about which team will win and by how much. With the emergence of parlay bets, which allow a single bet on multiple wagers, many hungry gamblers are looking for big gains and customized bets. Numerous platforms offer the means to make such wagers with intuitive interfaces and pretty generous welcome offers to attract new members.

Though the sports-betting scene has become quite crowded in recent years, thanks to the legalization of sports betting, I continue to view the top dogs—think DKNG and FLUT—as the best of the batch to continue dominating the massive market, which Goldman Sachs (NYSE:GS) believes could grow to become a massive $45 billion business. In any case, I’m bullish on both DKNG and FLUT as they look to skate further ahead of the competition.

DraftKings (NASDAQ:DKNG)

DraftKings has been a raging bull since bottoming at the end of 2022, with 273% in gains since those now-distant lows. Yesterday, DKNG reported an impressive earnings report (a massive 53% year-over-year pop in quarterly sales growth), with a surprise first-quarter profit and a slight upward adjustment to its full-year sales guidance (now expecting $4.9 billion revenue, up from $4.8 billion). Nonetheless, the stock has been pretty muted following the results.

Moving ahead, Goldman Sachs (NYSE:GS) expects DKNG stock to surge toward $60 per share, which is just $14 or so shy of all-time highs. Such a price target implies over 40% upside from current levels.

What can help get DKNG to these heights? The bank sees “future state legalizations” and “growth in existing states” as factors that will benefit DraftKings’ growth. I couldn’t agree more. DraftKings has a pretty high growth ceiling, and it could be raised gradually over the coming years should more states warm up to digital gaming platforms.

When it comes to the sports betting plays, DraftKings is king. It’s got the leading brand and deep enough pockets to bet on innovative tech. Specifically, its “data science powerhouse” is one of the key pillars that differentiates it from its rivals.

Advancements in data science and analytics could jolt the amount each user bets as its personalization and automation tech seeks to discover the bets its gamers want to place without them having to lift a finger. Indeed, customized parlays add to that personalization factor, which may also add to the thrill of sports betting for some.

All things considered, DraftKings is a tech-savvy sports betting company whose dominance will be tough to top.

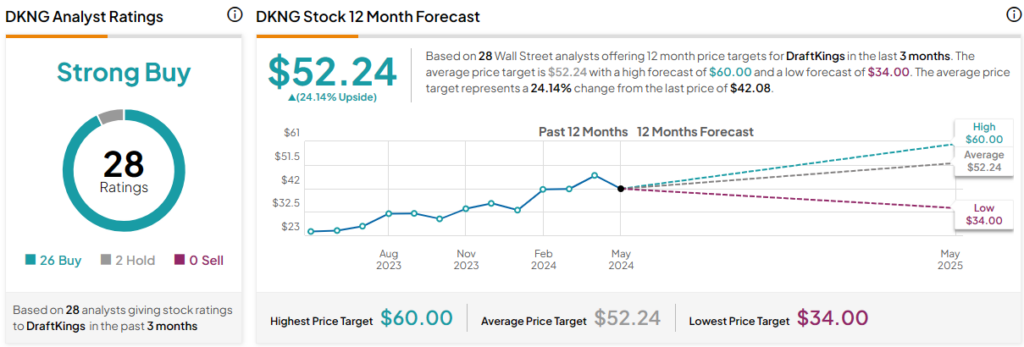

What Is the Price Target for DKNG Stock?

DKNG stock is a Strong Buy, according to analysts, with 26 Buys and two Holds assigned in the past three months. The average DKNG stock price target of $52.24 implies 24.1% upside potential.

Flutter Entertainment (NASDAQ:FLUT)

Flutter is another intriguing sports betting play, perhaps best known as the owner of FanDuel. Undoubtedly, the FanDuel brand seems every bit as powerful as DraftKings. But shares haven’t been nearly as hot as DKNG stock in the past three months. Indeed, the $34 billion company may be a cheaper alternative to game the booming sports betting scene, especially following its ugly March correction.

For me, the big draw is the lower price of admission to FLUT stock, with shares currently trading at 32.1 times forward price-to-earnings, far less than that of DKNG stock, which goes for over 120 times forward price-to-earnings. Sure, DraftKings may have the wind at its back, but I wouldn’t count Flutter out of the game now that it’s officially a public company with the means to defend its turf.

Most notably, the company’s parlay offerings have helped FanDuel stay ahead of emerging rivals in the scene, according to CEO Peter Jackson.

Overall, FLUT stock stands out a more of a growth at a reasonable price (GARP) type of play than DKNG. And though I’m bullish on both stocks, I have to give the slight edge to FLUT stock. The far lower multiple gives it the better odds of gains, in my humble opinion.

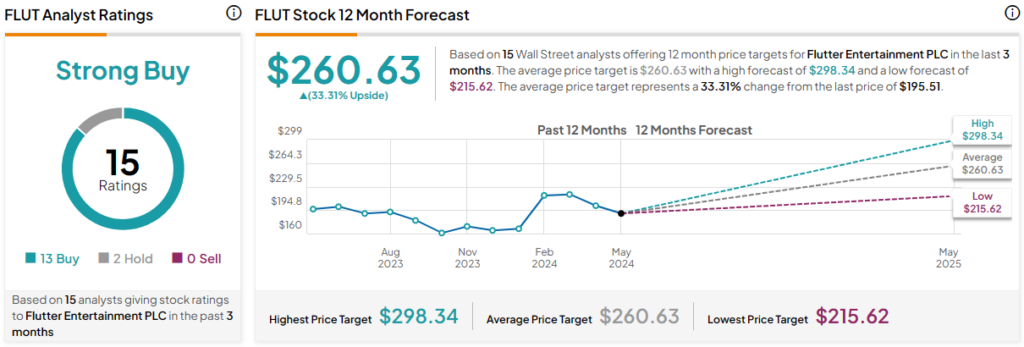

What Is the Price Target for FLUT Stock?

FLUT stock is a Strong Buy, according to analysts, with 13 Buys and two Holds assigned in the past three months. The average FLUT stock price target of $260.63 implies 33.3% upside potential.

Conclusion

Sports betting isn’t just about getting gamers to take their bets from the local sportsbook to their digital apps, but they may also be looking to entice sports fans to make their first bets. After betting with some promotional cash, perhaps one could get hooked on making parlays on their favorite teams or athletes, which would, of course, benefit DKNG and FLUT. Of the duo, analysts see FLUT as having more room to run from here.