2024 Kansas City Chiefs Parade & Victory Rally DonsESLAdventure/iStock Editorial via Getty Images

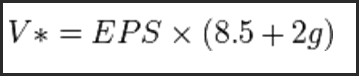

Premise: We are grateful to SA contributor Chuck Carnevale, who on Sept. 20th, 2013 devoted a full article toward explaining the Ben Graham intrinsic value formula calculation. Since then, innumerable other approaches have surfaced. We like Graham’s because we believe it lays out the simplest, most potentially accurate way to gauge intrinsic value. It’s not perfect, but useful in putting valuations in long-term context for serious investors :

intrinsic formula (SA)

V= intrinsic value

EPS=TTM earnings per share

8.5 P/E base for a no growth company

G= reasonably expected 7 to 10 year growth value. That’s how the $278 call was arrived at.

Flutter Entertainment plc (NYSE:FLUT), the UK sports betting giant, and its then-prime competitor, US-based FanDuel (“FD”), had sector leadership baked in from day one when the US Supreme Court opened the gateways to legal sports betting in May 2018. Both led the market in the fantasy sports sector. Doing a leap from their huge fantasy database into real money sports betting was a lock. The band of wannabes who crowded into the market swiftly, the two fantasy leaders, had millions of perfect demo customers fall into their laps instantly. FD and DraftKings Inc. (DKNG) did.

Entering with some ready to go databases from their casino businesses, Caesars (CZR) and MGM Resorts (MGM), both had to still overspend marketing strategy that led to massive losses. Competition came so hard and fast that the two leaders had to pour tons of cash nonetheless.

As a result, nobody made money. And most are still fighting off red numbers each quarter despite shaving promotional costs. But BetMGM is now third, turning profitable, and Caesars is reducing the promo spend.

The fundamentals of the sports betting business prevailed from day one: Its b nature, it’s a low margin business with few barriers to entry where product differences mean little. Controlling retention echoes the dilemma of streaming TV services. You need to promote to hold share, but it drains budgets badly.

It is now near seven years since the SCOTUS decision. The fundamentals haven’t materially changed, except efforts to reduce promotional spend to bring the businesses closer to profitability have speeded up.

Yet, despite the massive digging in of competitors, the two giants continue to battle it out at the top. Together, by many estimates, FLUT and DKNG control between 68% and 72% of the entire US sports betting market.

With $11.4b in total 2023 revenue for the sector according to the AGA, we have assigned a flat 35% share of the two leaders since their actual shares are so close. And they can vary month to month. It breaks down to leadership by market. In some states, it is FD, others have DKNG leading the revenue race.

Total US market shares at writing

#1 FanDuel: 35%

#2 DraftKings 32%

#3 Bet MGM 11%

#4 Caesars 6%

All others: 16%.

So the two leaders should reach ~$3.85b to $4b+ revenue this year, moving at a CAGR pace of 17.29% through to 2029 according to Statistica.

FLUT has turned profitable this year, moving from a ($711m) loss last year to $85m or more profit this year. DKNG is also poised to move into profitability.

Above: The top US market share goes to FanDuel of Flutter, but can vary month to month. Overall, FD holds its #1 position by a small margin.

By far, these are the primary forces driving sales in the sector: 1) the growth of total average daily users: AGA’s study last spring had ADUs for the two leaders combined as between 1.8m to 2.m for the pair.

That is expected to double or more by 2929. So betting on one or both stocks as long-term positions we see at their current prices buy opportunities. In both cases, we believe the stocks are fairly priced, with intrinsic values stretching the price of their stocks even more than their current trading.

However, DKNG rates a $40 intrinsic value, roughly 13% undervalued. We like FLUT better because even though it trades at more than 5X that of DKNG, it brings a level of stability with its massive UK and global presence. 2023 revenues hit over US $11b.

Furthermore, we see its resource base as deeper due to its overall scale. And its possible market share breakaway by 2026. DKNG will do fine, but we see its growth more likely coming from a transaction to merge.

FanDuel’s performance accounted for the biggest contribution to revenue gains for the parent’s year, at 37%.

Google

Above: Trajectory pre-NFL season augers well for an entry point now.

Bear in mind, FLUT at its late January NYSE opening this year hit the market at $164. Its price at writing is $218. During the year, the stock hit a year low at $88. This was almost entirely due to Mr. Market being alarmed at the news that the state of Illinois intended to run a massive increase in the sports gaming tax rate.

Fear that the move on taxes would spread to all states, plus the initial loss of $80m, drove a sell-off for the entire sector. There was immediate chatter that the sites were resigned to pass the increase to customers. The industry responded by denying that rumor with an announcement that they would absorb the increased tax through their systems.

This cooled the heads of investors, who began a northward course again that has brought the stock back strongly note to $218.

Starting the NFL season on positive investor sentiment makes our case for the upside on the stock through at least next spring.

The NFL season bares gifts

The NFL season schedule and story lines this year will contribute heavily to revenue gains for the sector in general and FD with its scale.

Per usual, the armies of NFL football forecast gurus are invading the media with massive data drops and forecasts for wins and losses for teams. What you see sparsely covered even in this day of media glut is how this season may be loaded with events that will spur betting.

These are more situations, people and match ups that promise to add to betting volume as well as outcomes. The starting gate for this season aims to have a record-breaking handle.

google

Above: FLUT’s brand dominates a crowded field, with only DKNG at parity.

Story lines abound to build volume fast

You have the debuts of an unusual number of highly touted rookie quarterbacks, as well as the return of legends. Caleb Williams alone brings excitement that is clearly going to spur record handle for the Bears. (He’s off to a slow start, but that will change.)

The return of Hall of Famer Aaron Rogers to the Jets has entered mainstream news. All over the league we have dangerous underdogs according to my sources in the betting community.

The NFL games delivered 93% of all the top 100 TV shows last year and is expected to top that this year. I asked my sources if they saw rises in betting volume ascribed to the mix of teams, heightened awareness of players and personalities with story lines could impact betting volume. All five of those pros I reached responded yes.

Here’s one famed guru’s answer: “Listen, that’s what this game is all about and has been since day one. You have crap seasons where dogs are long identified. You have division leaders who throw down fortress bets on favorites.”

This action feeds convictions that it’s all about the season sleeping to a Super Bowl with Patrick Mahomes leading another flock of lambs to the slaughter.

But when the story lines are as pulsating as they are this year, it is different. It has to creep into the bones of the bettors, and they will be throwing down extra cash as we move through the season.

On their phones betting, a cold brew in one hand and smartphone in the other, the cascade of bettor money is about to begin, even in places unexpected. Briefly, US bettors are ready to move NFL bets to record volumes this season. This should begin to surge in late October.

FLUT for its scale with be reaping a harvest of big money bettors that will find its way in 3Q and 4Q results big time—in percentage advance from last year beyond expected organic growth.

Above: An especially ripe season for NFL betting provides an entry point.

We’re looking at a strategic entry point, driven by prospects of an unusually ripe season. Given FLUT’s leadership, scale and international volume also on a regular rise. We see an entry point for Flutter Entertainment plc stock right now as having a strong upside and a modest downside risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.