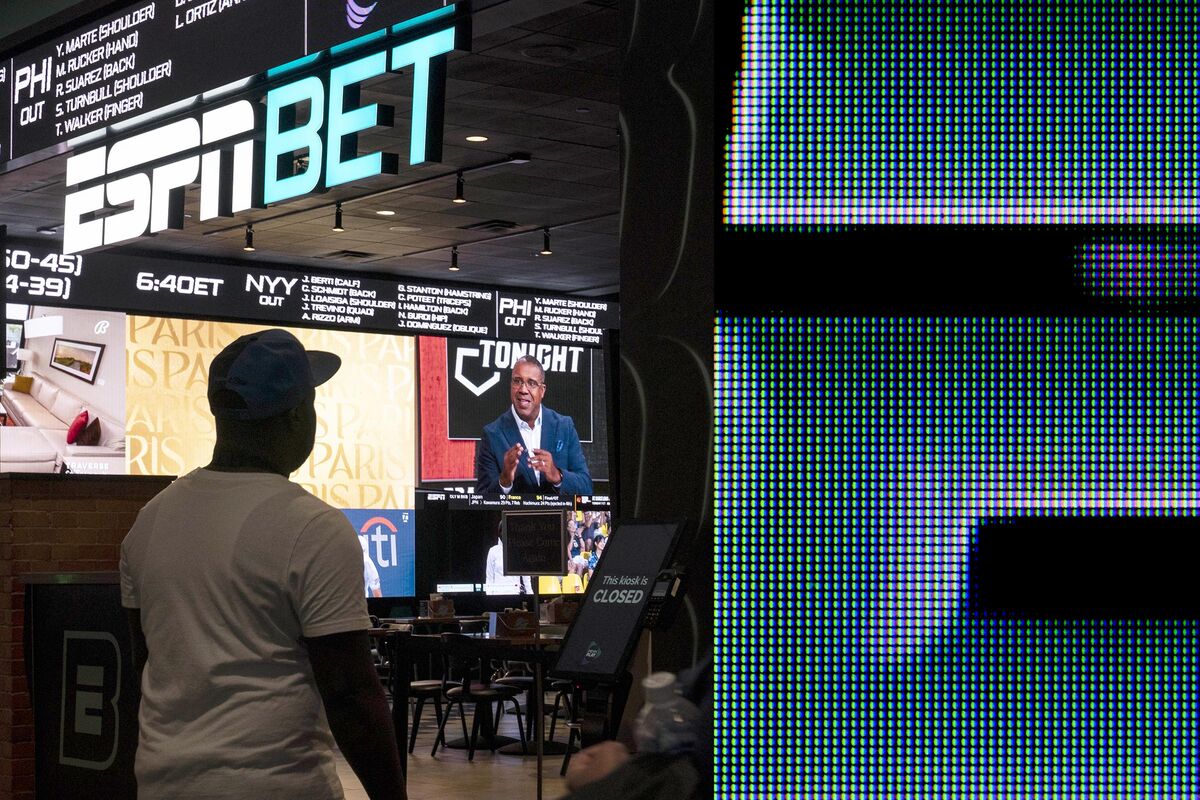

In the summer of 2023, ESPN Inc. and casino operator Penn Entertainment Inc. announced a 10-year, $2 billion deal. Penn, which was in a partnership with media company Barstool Sports Inc., had bolted for the self-proclaimed “Worldwide Leader in Sports.” On a call with analysts, Penn Chief Executive Officer Jay Snowden said, “We think we’re going to be a major player.” He dismissed as “crazy talk” the idea that the sports betting battle had been won already by Flutter Entertainment Plc’s FanDuel and DraftKings Inc. ESPN Bet, as the venture would be called, is “going to have an impact on what that overall market share looks like,” he said.

After its debut in November, the ESPN Bet app saw a surge in sign-ups as it gave away $200 in bonus bets to new players. As of May, the latest month for which data is available, ESPN Bet had a 2.8% share of the US online sports betting market, putting it in sixth place, according to research firm Eilers & Krejcik Gaming LLC. And while that’s up from the 1.7% Penn had a year ago with Barstool, together FanDuel and DraftKings have almost 74%. (Penn says it should be judged only on the 18 states where ESPN Bet is available. By that measure its market share is 3.9%, according to Eilers.)