Sporttrade has secured a sports betting license in Virginia, marking the company’s fifth U.S. market. Despite the approval arriving on the eve of the NFL season, Sporttrade plans to officially launch operations in the state in October.

Virginia, a key sports betting market due to its proximity to Washington, D.C., and home to major league teams, ranked ninth nationally with a betting handle of $415.4 million in June, outpacing neighboring North Carolina by $15 million.

Sporttrade believes it will benefit from a second-mover advantage in Virginia, entering the market after competitors like WynnBET, Unibet, SI Sportsbook, and Betway shuttered operations in the state. The company’s decision to expand into Virginia was based on an analysis of factors including market size, licensing costs, and revenue-sharing expenses.

“Virginia is just a no-brainer state for us,” Sporttrade CEO Alex Kane told Action Network. He noted that the state ranks highly on the company’s “Sporttrade Economic Rating,” even outperforming states like Massachusetts and Ohio, which typically generate larger betting handles.

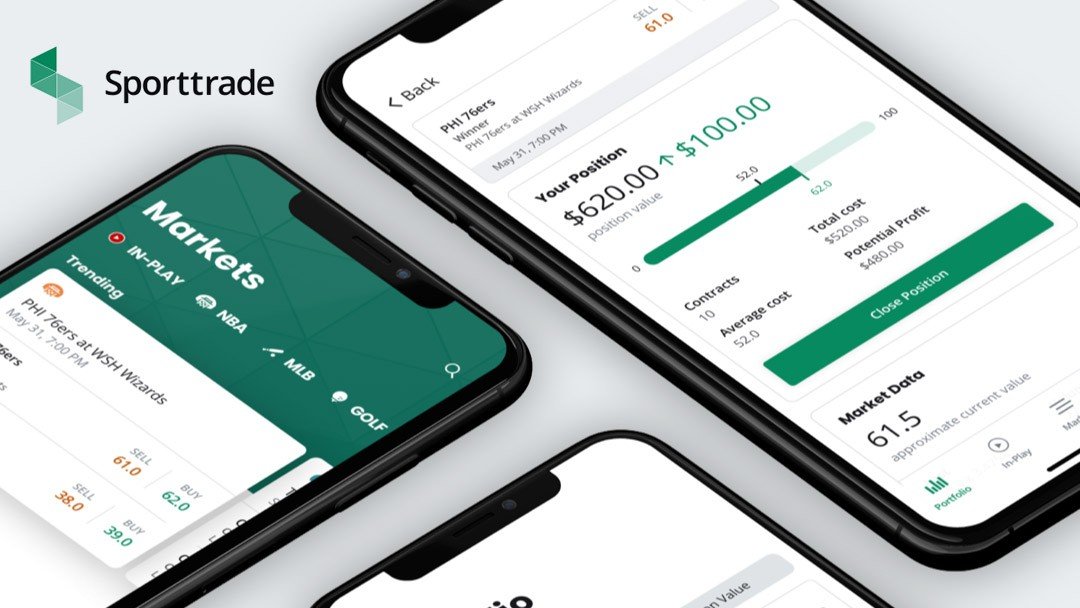

Sporttrade distinguishes itself from traditional sportsbooks by offering a stock market-style approach to sports betting. This model allows users to trade in and out of their positions, much like trading securities, providing flexibility to bettors.

A recently passed amendment in Virginia will also benefit newcomers like Sporttrade. Previously, sportsbooks could deduct all bonuses and promotions for tax purposes, but the new rule limits such deductions to a company’s first 12 months of operation. Established players like FanDuel, DraftKings, and BetMGM, as well as newer entrant Betr, will see their tax rates increase by about 40% after this week, according to Kane.

Sporttrade is also expanding its footprint beyond Virginia. The company gained market access in Arizona earlier this year and expects to go live in the state by mid-September.

In a competitive move, Sporttrade aims to offer more favorable pricing than traditional sportsbooks. For instance, during a recent NFL matchup, Sporttrade offered a better price on the Eagles at -135, compared to -140 at other major sportsbooks.

“We are truly marketing this product because we feel like it’s finally reached the maturity level to be successful and to be a captivating option for the premium player,” Kane said. Sporttrade’s focus on competitive pricing and in-game betting is part of its strategy to differentiate itself in the increasingly crowded U.S. sports betting market.