In his latest column, Tom Waterhouse of Waterhouse VC considers the role of sports data and data providers in revolutionising sports betting.

Eighteen years ago, mathematician Clive Humby coined the phrase “data is the new oil”, underscoring the vital role data would play in driving business and innovation. If not as scarce, high-quality data is just as valuable for sports and wagering.

Access depends on securing rights, with rising costs creating natural barriers to entry. AI and machine learning is now being applied to premium sports data to unlock new opportunities for fan engagement, especially in the wagering industry.

Data hasn’t always been as central to sport and wagering as it is today. Before televisions, attending a sporting event was the only way of knowing what really happened. Radio helped, but listeners were still reliant on the commentator’s account. In betting shops, trying to gauge how your bet was faring over shouting and excitement would have been a real challenge.

famously place her bets the day after the race was run. Source: The Telegraph

Hot models

Before the internet and data companies, betting used to rely largely on being ‘in the know’. ‘Gallop watchers’ might have had knowledge about a horse that even bookmakers didn’t possess, allowing them to place bets at superior odds before the information spread.

Today, social media has turned whispers into instant news and data access through the internet has transformed wagering into a more analytical endeavour. The world’s top betting syndicates (pools) now rely on finely tuned models which are driven by high-quality data to find their edge.

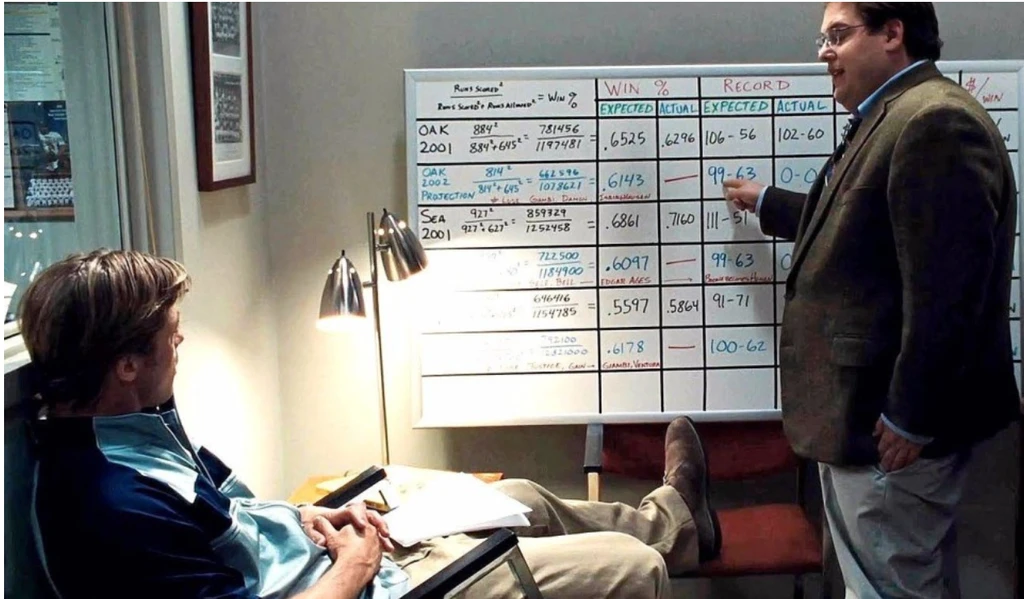

Was Michael Lewis’ Moneyball the birth of sports data?

It was Michael Lewis’s bestselling book Moneyball, later adapted into a film featuring Brad Pitt and Jonah Hill, that popularised data’s role in sport. The remarkable 2002 season of the Oakland Athletics showed how data could revolutionise scouting and team management and hinted at its potential to influence wagering.

By quantifying game events, statistics became invaluable for creating pre-match markets. With the continuous improvement of technology, in-play betting emerged, where real-time information drives odds adjustments almost instantaneously. This mathematical approach to running football teams and betting has been implemented by Tony Bloom, owner of Brighton and Starlizard as well as Matthew Benham, owner of Brentford and Smartodds.

Waydev

As the internet grew, companies like Sportradar and Genius Sports emerged. Initially focused on serving the wagering market through an odds aggregation tool, their role expanded to monitoring the integrity of sport through tracking suspicious betting patterns. Today, data companies drive everything from broadcasts and advertising to fantasy sports, wagering and league operations.

Sportradar turns to AI

Sportradar now has established partnerships with various sports leagues including the NBA, UEFA, ATP Tour and MLB, giving fans access to detailed stats on every team and player. Using AI models and in-venue scout coverage, they continue to redefine the fan experience. For teams, Sportradar provides advanced analytics through machine learning which helps with team selection, scouting and tactical decisions.

GlobeNewswire

Through their partnership with the NBA, fans can purchase a league pass to stream games and bet live, with prices updating automatically through Sportradar’s data. This automation eliminates the need for operators to run trading teams to manage their risk, significantly reducing their costs. In 2023, Sportradar’s revenue totalled €877.6 million, of which €649 million was generated from betting related services, whether that be from content, odds feeds or full-suite managed trading services (MTS). Other revenue streams include advertising and broadcast enhancement as well as integrity services for sports leagues.

Sports leagues partnerships unlocking new fan experiences

With partnerships with the EPL, EFL, FIBA and NFL, Genius Sports is changing the game for how fans consume and engage with sports. Their BetVision product for the NFL also capitalises on the rapid growth of sports betting in the US, with fans able to stream and bet in-play which is a high margin product for bookmakers. For 2023, 76% of total betting volume from streamers was from in-play betting during the NFL season.

Genius Sports is also working with respective leagues to improve the game itself. At Premier League grounds for example, the introduction of offside tracking powered by computer vision cameras will reduce game delays and the burden of big decisions for referees. The Premier League data zone showcases some of the capabilities which Genius can deliver to engage fans. In 2023, Genius generated US$413 million in revenue and they have just launched Genius IQ, offering unparalleled game analysis, performance insights and sportsbook optimisation for in-play betting.

Genius Sports and Sportradar cover some of the most-watched and bet-on sports leagues in the world and, as such, the distribution rights are costly, running into the hundreds of millions of dollars. However, the growth of global sports betting, especially in emerging markets, enables both companies to leverage technology to deliver significant returns on these investments.

Can data help revive horseracing?

Racing has historically been behind the curve when it comes to fan engagement, particularly when compared to global sport franchises like the Premier League and Formula 1. This is an issue because racing’s audience is ageing, a trend that threatens the sport’s long term sustainability.

To attract a younger, global audience, racing must follow the lead of innovators like Genius Sports and Sportradar who have shown that data is the lifeblood to any sport. RAS Technology Holdings (RAS) (ASX:RTH), with whom Waterhouse VC has just entered into a strategic partnership, is poised to lead this transformation.

RAS, better known as ‘Racing and Sports’, is a global leader in data, analytics and technology for the racing and wagering industry. Founded 25 years ago, they now possess one of the most comprehensive global racing databases, covering over 33 jurisdictions and extending to greyhound and harness racing.

Racing is a complex sport, often producing more questions than answers which can overwhelm newcomers. However, the solution lies in providing fans with digestible, actionable information about racing that demystifies the sport and makes it engaging. Racing and Sports is uniquely positioned to fill this void. RAS offers fans access to detailed race overviews, runner comments, speed maps, tips, proprietary rating and sibling reports for global racing.

With over 25 years of data, RAS is now showcasing the value of their data to operators, fans, racing bodies, trainers and bloodstock agents. Since listing in 2021, RAS’s annual revenue has grown from AU$5.3 million to AU$16.2 million, driven by effective distribution capabilities and partnerships that recognise the immense value of their offerings.

For operators, racing has always been a high-margin product and unlike any other sport, it runs 24/7, but to maintain and grow this profitability, it’s essential that punters feel informed enough to engage with the sport.

Stake is re-engaging younger racing fans

The recently launched partnership with online crypto operator Stake.com (discussed in our August newsletter) where RAS has built a complete racing solution, coupled with a surge of interest from crypto operators seeking new products, positions racing to re-engage with a younger, more global demographic. RAS also offers a managed trading service, allowing operators to leave the risk management to their highly sophisticated, AI-driven, automated trading platform, which provides rapid trading decisions, making it easier for emerging operators to succeed.

RAS has a critical role to engage racing fans and attract new audiences. Increased interest naturally leads to ownership opportunities and, as the sport becomes better funded through operator contributions, the prize money can make it an even more attractive proposition and help secure the sport’s future through genuine long-term interest.